Click to play video

INDICATOR

Please Register for FREE account or Login to subscribe to this indicator.

By subscribing, you agree with our Terms & Conditions

This highly useful NinjaTrader 8 indicator plots today’s market deviation live from the opening price. It also tracks deviation compared to short- and long-term periods. You have the flexibility to choose your preferred time periods for both short- and long-term analysis. This is one of the most useful day trading indicators suitable for both day traders and swing traders. This Premium Indicator tells you whether the market is stretched too much or not compared to short- and long-term. Historically, if the market is extremely stretched, it is highly likely to reverse, and this indicator will help you find out exactly what to do when making your trading or investment decisions.

See how the Current Deviation - Premium Indicator looks in action with these screenshots

Learn how to use the Current Deviation - Premium Indicator to improve your trading

The Current Deviation custom-programmed indicator is developed to be used on the NinjaTrader 8 trading platform by Rize Capital. This is a simple but very effective indicator to use. This indicator is based on how the current market deviates or stretches compared to short and long-term market ranges. If the market is volatile and stretched too much, it is highly likely to bounce back. The information marked by the left white arrow in Image 1 provides crucial information for you so that you can make your trade entry or exit based on that.

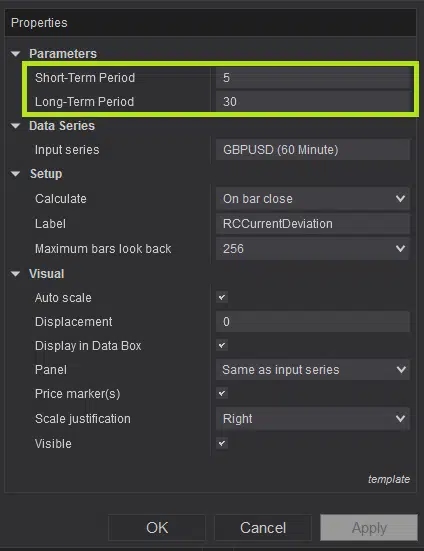

‘Long Range’ gives you how the market has moved or the average range for your selected ‘Long-Term period’ in the settings, and ‘Short Range’ gives you the same for the selected ‘Short-Term Period’, as shown within the lime green rectangle in Image 3. These two pieces of information are very useful for you in understanding how the market behaves for this instrument over both long- and short-term periods. ‘Difference’ plots the difference of the Long- and Short-term periods’ ranges.

‘Today’s Range’ shows you today’s market range so far and gives you the live market range to understand how volatile the current market is. ‘Short Diff’ and ‘Long Diff’ plot the difference of today’s range compared with the Short and Long Ranges, respectively. These two values are very important, as they inform you whether the current market is too stretched compared to the Short or Long-term range. If it’s a positive number, it means the current market has not crossed the respective range, whereas a negative number means it has moved beyond what it did during the Short or Long-term periods. Now, the numerical values of these two will indicate how seriously it has stretched beyond its Short- and Long-term regular movements over the selected periods.

This indicator works on any market, and any instrument. Now, the number of days' data loaded on your chart needs to be more than your selected ‘Short-Term Period’ and ‘Long-Term Period’ in the settings. However, if you forget, it will remind you with a text, as shown in Image 2, so that you can load more data onto your chart.

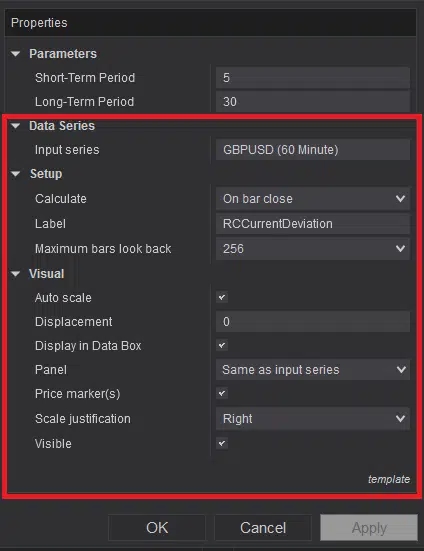

The settings marked within the red rectangle in Image 4 are default settings, and it is highly recommended not to change these settings for the proper functioning of this indicator. If you still have any further queries, feel free to watch the video tutorial above to learn how this indicator and its settings work.

See how the Current Deviation - Premium Indicator has evolved over time