Click to play video

Tutorial with Source Code

Please Register for FREE account or Login to purchase this source code.

By downloading, you agree with our Terms & Conditions

The Time Box Scalper Strategy is an advanced NinjaTrader scalping bot that identifies and captures high-momentum breakouts within fully customisable time windows. When you purchase the Time Box Scalper Strategy from Rize Capital, you receive the complete NinjaScript source code for the best scalping strategy, providing total freedom to modify the breakout detection logic, customise the time box parameters and momentum filters, adjust the news avoidance settings, or integrate the strategy into your own automated trading systems with no restrictions whatsoever. For a detailed overview, check out our video tutorial above.

See how the Time Box Scalper - NinjaTrader 8 Strategy looks in action with these screenshots

Learn how to use the Time Box Scalper - NinjaTrader 8 Strategy

The Time Box Scalper Strategy for NinjaTrader 8 combines time-based volatility analysis with intelligent momentum confirmation. The core functionality centres around automatically drawing customisable rectangular time boxes that define specific market phases where breakout opportunities are most likely to occur, such as session opens, initial balance periods, or any custom trading window you select.

As shown in Image 1 (pointed by yellow arrows), the shaded time box appears automatically on your chart between your defined start time and duration, visually highlighting the active observation window. The strategy continuously tracks the highest high and lowest low within this box, monitoring price compression and buildup. The box opacity, fill colour, and outline are fully customisable, allowing traders to maintain clean chart aesthetics whilst clearly identifying their breakout zones. This visual framework eliminates guesswork about when the strategy is actively monitoring for opportunities.

The strategy eliminates manual execution through sophisticated automated signal generation. In Image 2 (pointed by white arrows), when price breaks above the time box high with confirmed ATR volatility and volume exceeding their respective breakout thresholds, the strategy automatically triggers a long entry with protective stop-loss and profit target instantly placed. Conversely, when price breaks below the time box low with momentum confirmation, a short entry is executed automatically. The dual confirmation system—requiring both volatility expansion (measured via ATR) and volume surge—filters out false breakouts and ensures only high-probability setups trigger trades. When the Force Flat at Box End option is enabled, all open positions are automatically closed once the time box period expires, providing strict session-based risk control ideal for scalpers and intraday traders.

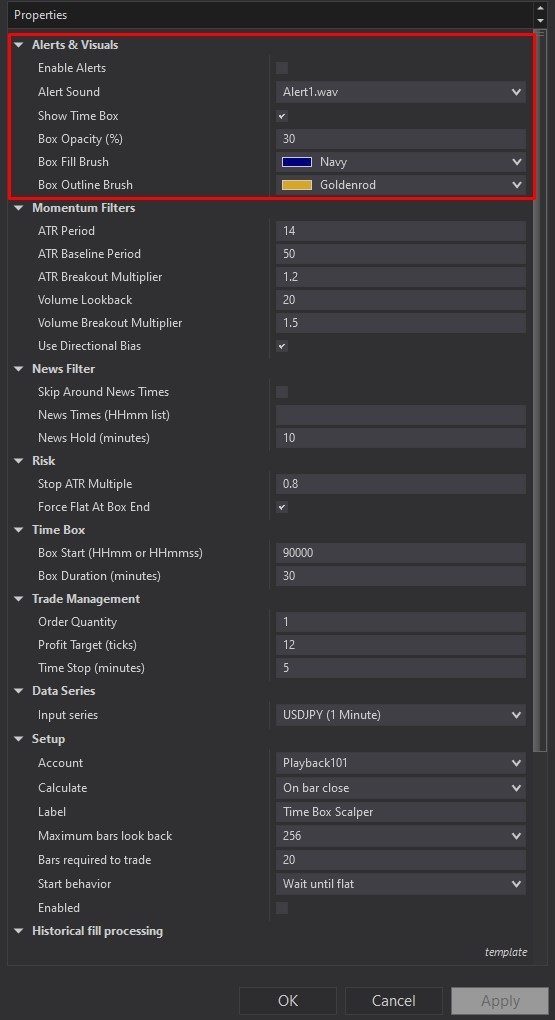

Time Box Scalper Strategy offers comprehensive control through its extensive settings panel. The Alerts and Visuals section, highlighted by a red rectangle in Image 3, provides complete notification and display customisation. Enable Alerts activates pop-up and sound notifications whenever new trades trigger, perfect for multi-chart monitoring without constant screen watching. The Alert Sound dropdown allows selection from NinjaTrader's built-in audio library for personalised confirmation. Show Time Box toggles the visual rectangular display on the chart, whilst Box Opacity adjusts transparency levels (higher values increase visibility). Box Fill Brush and Box Outline Brush controls allow complete colour customisation of the box interior and border, ensuring the breakout window stands out clearly against your chart background and price action.

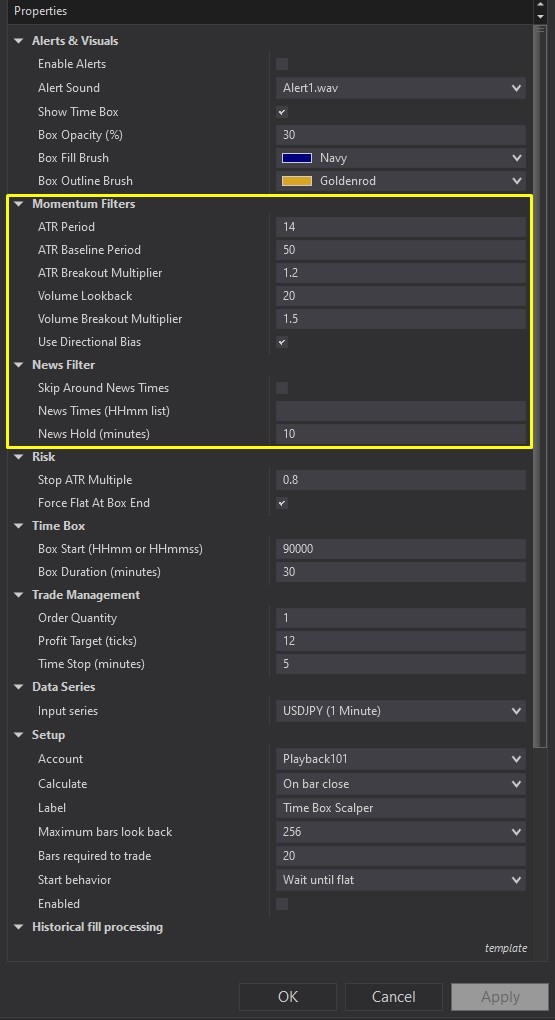

Image 4 displays the Momentum Filters and News Filter configuration options, highlighted by a yellow rectangle. The Momentum Filters subsection defines the sophisticated detection logic—ATR Period sets the lookback length for measuring current volatility, whilst ATR Baseline Period establishes the longer reference window for comparing current volatility against normal background levels. The ATR Breakout Multiplier determines how much stronger current volatility must be than baseline before qualifying as a genuine breakout (e.g., 1.5x means current ATR must exceed 1.5 times the baseline). Volume Lookback sets the number of bars for calculating typical volume, and Volume Breakout Multiplier specifies how much greater current volume must be compared to average volume to confirm real market participation. The Use Directional Bias toggle adds an additional confirmation layer by only taking long trades on bullish bars and short trades on bearish bars. The News Filter section represents critical risk protection—when Skip Around News Times is enabled, the strategy automatically prevents new trade entries near scheduled economic releases. Traders input specific times in the News Times List (comma-separated format like 8:30,10:00,14:00), and the News Hold Minutes parameter defines the buffer period before and after those times when trading pauses, keeping positions safely out of chaotic volatility spikes during major announcements.

The Risk Management and Time Box Setup sections control position protection and window definition. Stop ATR Multiple sets the protective stop-loss distance as a multiple of current ATR value, automatically adapting to market volatility—higher multiples provide wider stops for volatile instruments, whilst lower values tighten risk for calmer markets. Force Flat at Box End, when activated, closes all open trades immediately upon time box expiration, perfect for traders wanting strict session-based exposure without overnight or extended holds. Box Start defines the precise time when the observation window begins, allowing alignment with major session opens (London, New York) or custom periods. Box Duration Minutes sets the active monitoring length, typically ranging from 5 minutes for rapid scalps to 60 minutes for initial balance captures. The Trade Management subsection includes Order Quantity for position sizing, Profit Target Ticks for automatic take-profit distance from entry (set to zero for open-ended exits), and Time Stop Minutes as a safety feature that automatically closes trades after a specified duration, preventing unexpectedly extended position holds.

With full NinjaScript source code included, advanced users can study the complete time box calculation logic, modify the ATR and volume breakout algorithms, adjust the news filter timing mechanisms, customise the force-flat exit behaviour, integrate additional technical filters, or build entirely new automated strategies using the framework—all without any restrictions whatsoever. If you have questions about the strategy, refer to the comprehensive video tutorial above for detailed guidance.

Secure payment via PayPal

By downloading, you agree with our Terms & Conditions