Limited Time Offer Trade Entry Strategy - 75% OFFUse code RCTE75OFFGet the Deal

Click to play video

Tutorial with Source Code

Please Register for FREE account or Login to purchase this source code.

By downloading, you agree with our Terms & Conditions

The Trend Rider Strategy for NinjaTrader 8 is a professional-grade automated trading strategy that combines linear regression slope analysis with ATR-based volatility bands to capture strong directional moves while filtering out choppy market conditions. Developed by Rize Capital, the Trend Rider Strategy automatically enters long positions when the slope is positive and price breaks above the volatility band, and short positions when the slope is negative and price breaks below the band, with each trade protected by adaptive stop loss management and step-based trailing logic that progressively locks in profits as trends develop. The trend following strategy comes with complete source code ownership, allowing advanced users to customise the logic to their specific trading requirements and risk tolerance. Check out our video for a full NinjaScript tutorial.

See how the Trend Rider Strategy - NinjaTrader 8 Strategy looks in action with these screenshots

Learn how to use the Trend Rider Strategy - NinjaTrader 8 Strategy

The Trend Rider Strategy is a fully automated, custom-programmed strategy developed by Rize Capital to use with the NinjaTrader 8 trading platform. This strategy works with any instrument and any bar type, automatically identifying trending regimes using linear regression slope analysis combined with ATR-based volatility bands to capture strong directional moves while filtering out choppy, sideways markets. The strategy operates by calculating a regression midline with directional slope and dynamic volatility bands that expand during momentum and contract during quiet periods, as shown in Image 1.

The strategy automatically displays visual regime indicators on your chart with colour-coded backgrounds that highlight current market conditions (as demonstrated in Image 1). A transparent background represents quiet, low-volatility markets where the strategy suppresses weak trades. When the slope is positive and conditions align for long entries, the background turns green (Image 2, pointed by white arrows), whilst negative slope conditions ready for short entries turn the background red (Image 3), providing instant visual feedback on the current trending regime.

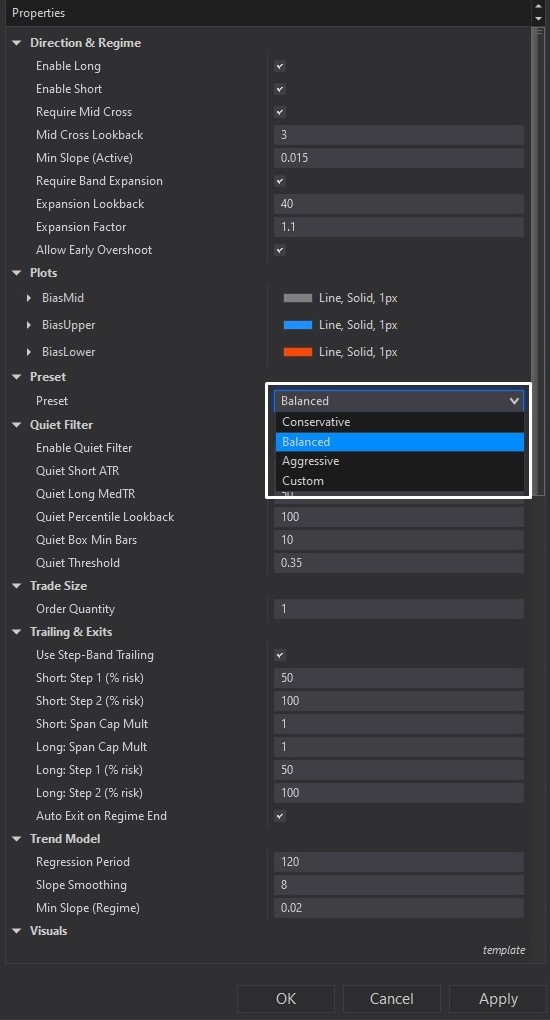

Trend Rider features multiple preset configurations accessible through the strategy parameters: Conservative, Balanced, Aggressive, and Custom options (highlighted in Image 4 with a white rectangle). Each preset adjusts regime filters, slope requirements, and band expansion criteria to suit different trading styles. The Balanced preset serves as the default for medium sensitivity, whilst Conservative generates fewer but higher-quality trend trades with stricter filters, and Aggressive provides more frequent momentum opportunities with relaxed entry conditions.

The strategy incorporates sophisticated adaptive risk management with step-based trailing stop logic. When a trade is entered, a protective stop loss is immediately placed at the outer ATR band. As the trade moves in your favour, the stop trails progressively: first to the midline after covering 50% of initial risk (Step 1), then to the inner band after reaching 100% risk coverage (Step 2), and continues trailing dynamically to lock in profits while riding the trend. This step-based system ensures losses are minimised whilst profits are protected.

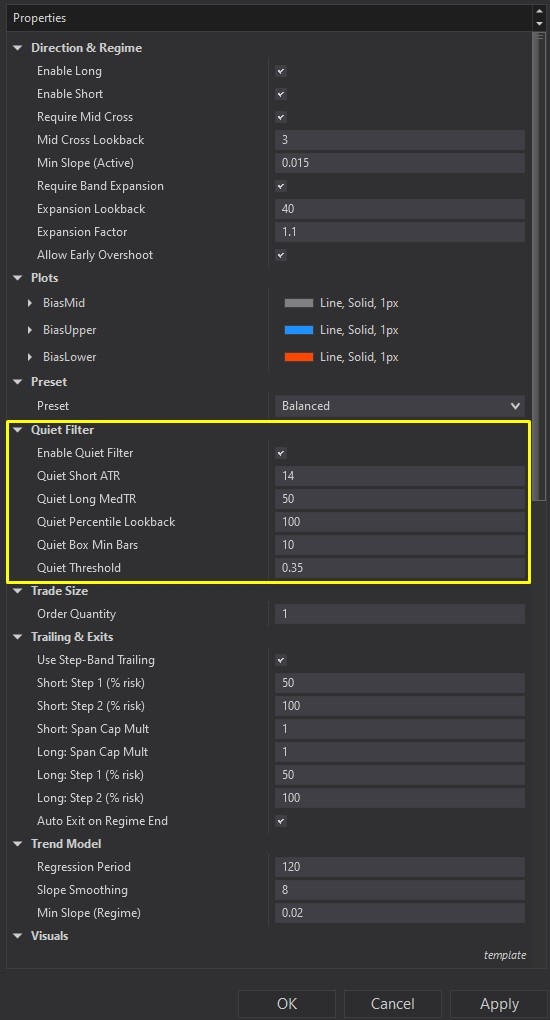

The strategy also features an intelligent quiet zone filter that suppresses trades during low-volatility compression periods to avoid choppy whipsaws (Image 5; highlighted with a yellow rectangle). Using fast ATR and median true range calculations with percentile ranking, Trend Rider identifies when markets lack momentum and pauses trade execution until meaningful volatility returns, significantly reducing false signals in sideways conditions.

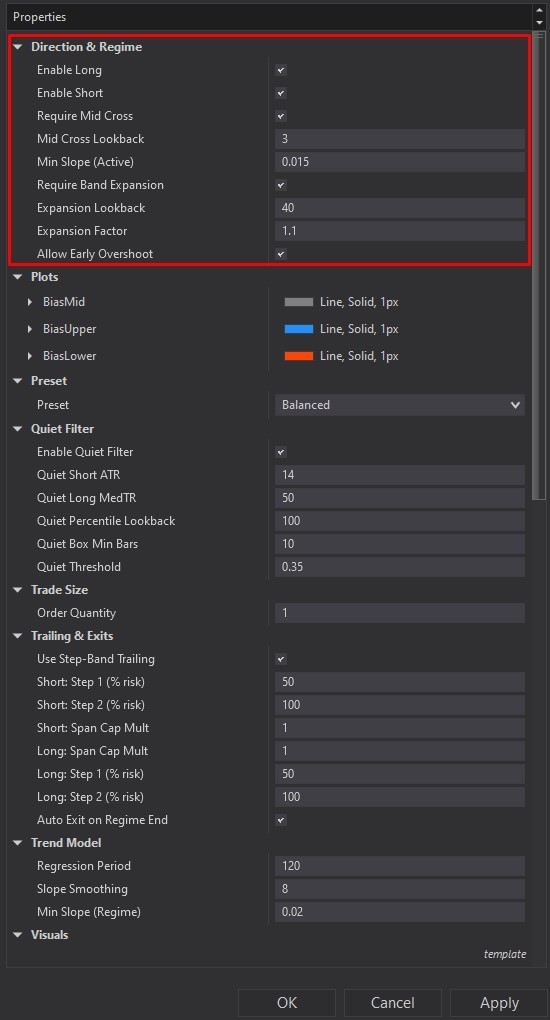

Trend Rider includes multiple regime entry filters that can be enabled or disabled based on your preferences (highlighted with a red rectangle in Image 6). The "Require Mid-Cross" option ensures price crosses the regression midline before starting a trade, reducing false signals. The "Require Band Expansion" filter only allows trades when volatility bands are actively expanding, confirming genuine momentum. You can also enable "Allow Early Overshoot" to capture explosive moves when price breaks strongly beyond the bands.

Now, it's impossible to always monitor the trading platform to know when positions are entered or exited. That's why Trend Rider includes comprehensive alert functionality that can notify you when trades are executed. The strategy also features an "Auto Exit on Regime End" option that automatically closes positions when the identified trend regime weakens or reverses, preventing you from holding trades in deteriorating conditions.

The trade quantity (position size), trailing stop parameters, and step-based profit milestones can be fully customised through the parameters panel. Additionally, you can enable or disable long and short trade directions independently, allowing you to focus exclusively on bullish or bearish setups based on your market outlook or trading preference.

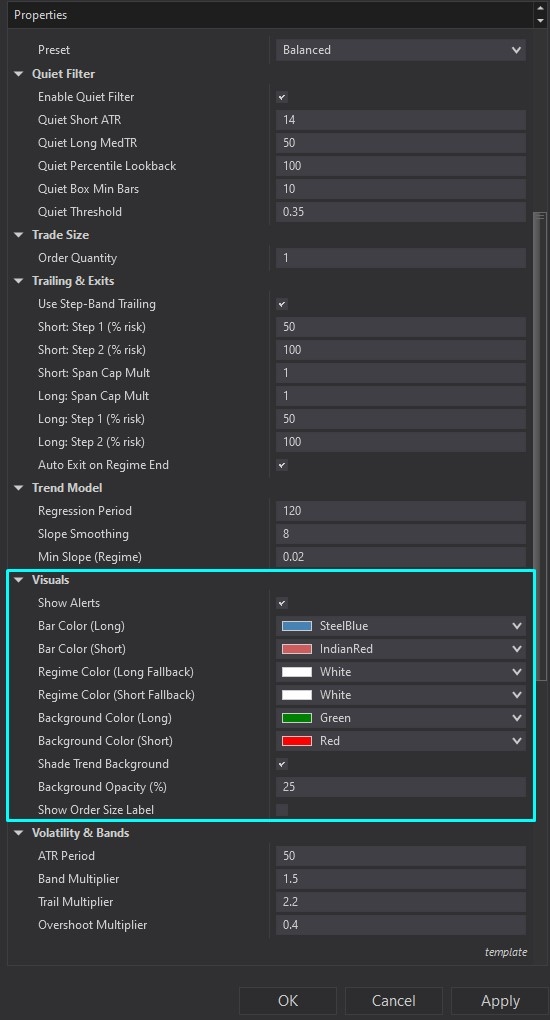

The strategy provides extensive visual customisation options (highlighted with a blue rectangle on Image 7), including the ability to colour chart bars based on regime (long = green, short = red), adjust background opacity for regime shading, and display the regression midline and ATR bands directly on your chart. You can also enable an on-chart order size label to see your current position size at a glance.

It is strongly advised to avoid modifying the core algorithmic settings (regression periods, slope calculations, ATR formulas) to ensure proper functionality, though all risk management, visual, regime filters, and trade execution parameters can be adjusted to match your specific trading requirements. When you purchase the Trend Rider Strategy from Rize Capital, you receive complete NinjaScript source code with full ownership rights, providing total freedom to modify and enhance the strategy as needed.

Secure payment via PayPal

By downloading, you agree with our Terms & Conditions