Click to play video

Tutorial with Source Code

Please Register for FREE account or Login to purchase this source code.

By downloading, you agree with our Terms & Conditions

The TrendGuard Pullback Pro is a fully automated pullback trading strategy developed for NinjaTrader 8 that identifies and executes high-probability pullback entries within established trends. It combines a dynamic linear regression trend line with adaptive ATR-based volatility zones and volume confirmation to pinpoint precise continuation opportunities, automatically entering trades when price retraces into validated pullback zones with momentum backing. When you purchase the TrendGuard Pullback Pro from Rize Capital, you receive the complete NinjaScript source code. For a detailed overview, check out our video tutorial above.

See how the TrendGuard Pullback Pro - NinjaTrader 8 Strategy looks in action with these screenshots

Learn how to use the TrendGuard Pullback Pro - NinjaTrader 8 Strategy

The TrendGuard Pullback Pro Strategy for NinjaTrader 8 revolutionises trend-following trading by automatically identifying and executing high-probability pullback entries within established directional moves. The core functionality centres around a dynamic linear regression midline that defines the active trend direction, surrounded by adaptive ATR-based pullback zones that expand or contract with market volatility to capture optimal retracement entry points.

As shown in Image 1 (pointed by white arrows), the blue linear regression midline represents the current trend trajectory, calculated over a customisable period to provide either responsive or smooth trend definition depending on your trading style. The shaded pullback zones (pointed by yellow arrows) automatically adjust their width based on ATR multiplier settings, creating wider zones during volatile sessions to accommodate deeper retracements and tighter zones during calm markets for precise entries. These zones serve as the critical areas where the strategy validates continuation opportunities—when price retraces into a zone after an impulse move, the system begins monitoring for volume confirmation and momentum resumption signals. The zone opacity and colouring are fully customisable, ensuring the visual framework remains clear without obscuring price action or candlestick patterns.

The strategy eliminates manual execution through sophisticated automated trade management. In Image 2 (pointed by white arrows), when price enters a pullback zone and volume exceeds the average by the specified multiplier, the system validates a continuation setup and automatically enters the trade with precisely calculated protective stops. Long entry markers appear in customisable colours (default settings) when bullish continuation setups trigger, whilst short entry markers indicate bearish opportunities. The strategy offers two distinct risk management modes: Fixed Target Mode places a predefined profit target at a specified number of ticks from entry, providing structured risk-to-reward ratios ideal for scalping and day trading, whilst Trailing Stop Mode removes fixed targets entirely and instead follows price dynamically with a trailing stop that locks in profits as trends extend, perfect for capturing larger moves during strong directional sessions. Setup markers appear on the chart before trades trigger, providing visual confirmation of validated pullback opportunities, whilst fill markers indicate actual execution points. The system also displays colour-coded signal bars and maintains a real-time profit and loss panel showing both realised and unrealised results throughout the trading session.

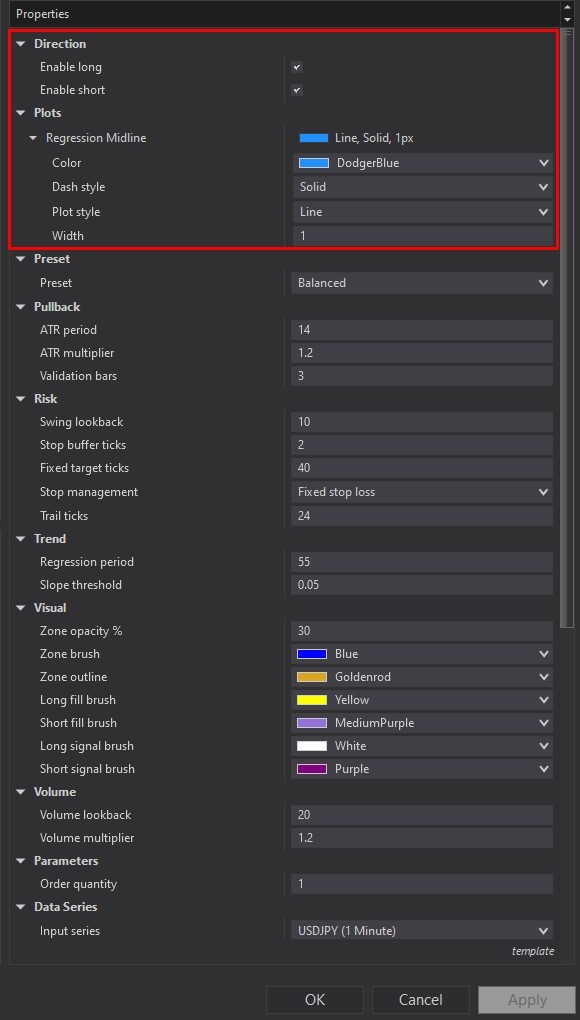

TrendGuard Pullback Pro offers comprehensive control through its extensive settings panel. The Direction and Plots sections, highlighted by a red rectangle in Image 3, provide fundamental operational controls. Enable Long activates bullish continuation trades when price pulls back in uptrends, whilst Enable Short enables bearish setups during downtrends. Traders can activate both directions simultaneously for full market coverage or focus exclusively on one side based on directional bias or market analysis. The Plots subsection allows complete customisation of the regression midline appearance—adjust colour, thickness (dash style), and line style to ensure the trend indicator stands out clearly against your chart background. The Preset dropdown offers four built-in behaviour profiles that automatically adjust multiple internal parameters: Conservative for cautious entries with tighter validation requirements and smaller position sizes, Balanced (default), providing optimal mix between opportunity capture and risk control, Aggressive for maximum trade frequency with relaxed validation thresholds, and Custom for traders who prefer manual tuning of every parameter. These presets automatically modify regression length, ATR multiplier, volume thresholds, and validation requirements, allowing instant adaptation to different market personalities without complex manual configuration.

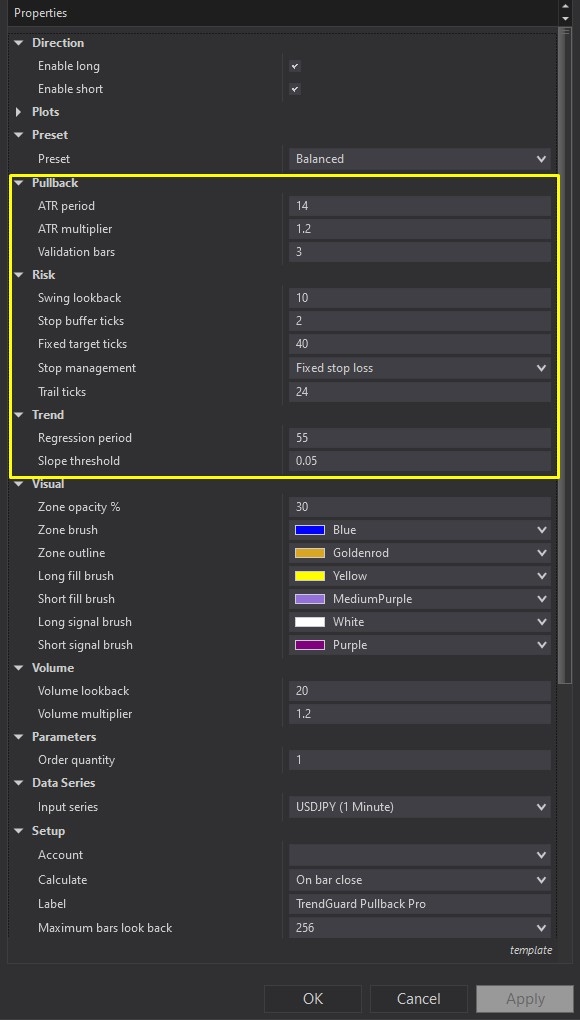

Image 4 displays the Pullback, Risk, and Trend configuration options, highlighted by a yellow rectangle. The Pullback subsection controls zone definition and validation logic—ATR Period sets the lookback length for volatility measurement (shorter periods react faster to changing conditions, longer periods provide smoother calculations), ATR Multiplier expands or contracts the shaded pullback zone width based on current volatility (higher values create wider zones suitable for volatile instruments like indices, lower values tighten zones for forex pairs), and Validation Bars determines how long the system waits for momentum confirmation after price touches the zone before cancelling the setup (this prevents premature entries on weak touches). The Risk subsection provides sophisticated trade protection mechanisms—Swing Lookback tells the system how many bars to scan backwards for identifying the last swing high (for shorts) or swing low (for longs) to place protective stops, Stop Buffer Ticks adds a safety cushion beyond that swing level to prevent stop-outs from normal market noise, Fixed Target Ticks defines the static profit objective distance for structured reward ratios, Stop Management toggles between Fixed Target mode (trades exit at predetermined profit level) and Trailing Stop mode (profits run with dynamic stop following), and Trail Ticks sets the trailing distance once trades move into profit (tighter trails lock profits quickly, wider trails allow extended runs). The Trend subsection contains the mathematical core—Regression Period determines the number of bars used for linear regression calculation (shorter values like 20 create responsive trends that adapt quickly, longer values like 50 produce steadier trends less affected by minor fluctuations), and Slope Threshold defines the minimum angle required for valid uptrend or downtrend classification (this critical filter ensures the strategy only trades strong directional markets and completely avoids choppy, sideways conditions where pullback setups fail frequently).

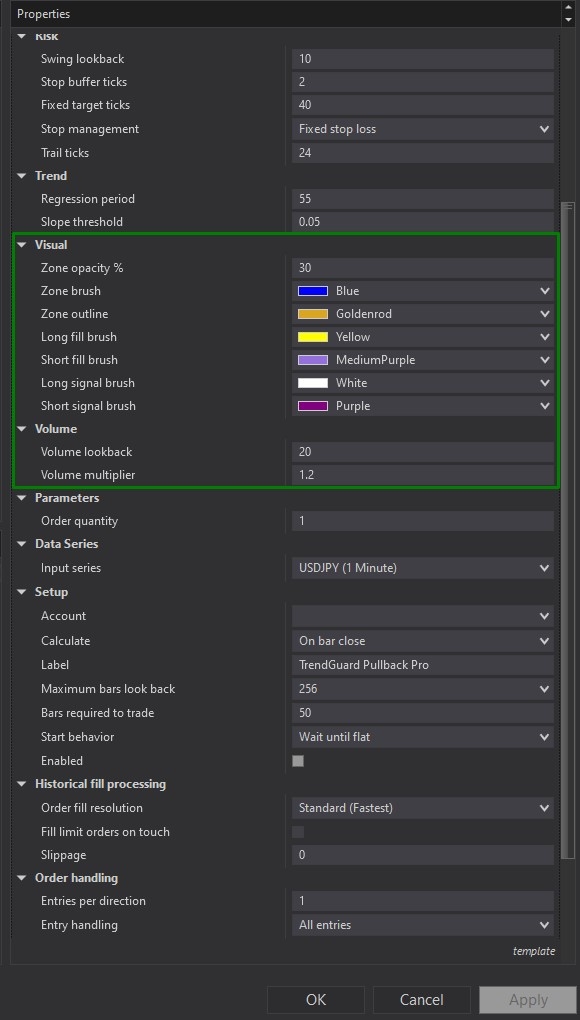

The Visual and Volume sections, illustrated in Image 5 (highlighted by a green rectangle), control chart appearance and momentum confirmation. Zone Opacity Percent adjusts the transparency of shaded pullback areas (lower values keep zones subtle for clean charts, higher values make zones prominent for clear visual reference), Zone Brush and Zone Outline define the fill colour and border styling for pullback areas, Long Fill Brush and Short Fill Brush customise the entry marker colours for each trade direction (instantly distinguishing bullish from bearish executions), and Long Signal Brush and Short Signal Brush determine the setup marker colours displayed before trades trigger (providing advance visual warning of pending entries). These comprehensive visual controls ensure the strategy's feedback system matches your charting preferences and provides instant recognition of trade progression. The Volume subsection implements intelligent momentum filtering—Volume Lookback defines how many previous bars calculate the average volume baseline, and Volume Multiplier sets the threshold current volume must exceed to confirm genuine market participation (e.g., 1.5x means current bar volume must be 150% of the average). This critical confirmation prevents entries during thin, easily-reversed moves and ensures every trade benefits from real institutional or retail participation. The Parameters section includes Order Quantity for position sizing, allowing traders to scale exposure up or down based on account size and risk tolerance.

With full NinjaScript source code included, advanced users can study the complete linear regression calculation algorithms, modify the ATR-based zone width logic, adjust the volume confirmation methodology, customise the swing-based stop placement system, alter the trailing stop behaviour, integrate additional technical filters such as moving averages or RSI, build custom profit-taking algorithms, or combine TrendGuard Pullback Pro with other strategies for portfolio automation—all without any restrictions whatsoever.

If you have questions about the strategy, refer to the comprehensive video tutorial above for a detailed guide.

Secure payment via PayPal

By downloading, you agree with our Terms & Conditions