Click to play video

Tutorial with Source Code

Please Register for FREE account or Login to purchase this source code.

By downloading, you agree with our Terms & Conditions

The VWAP Edge Bands is a professional-grade NinjaTrader VWAP indicator. It enhances the traditional Volume Weighted Average Price (VWAP) by incorporating adaptive, asymmetric deviation bands using rolling median absolute deviation calculations, designed to identify precise balance zones, breakouts, and mean reversion opportunities in real-time. When you purchase the VWAP Edge Bands from Rize Capital, you receive the complete NinjaScript source code, providing total freedom to modify the calculation logic, customise the band multipliers and visual parameters, or integrate the indicator into automated trading systems with no restrictions whatsoever. For a detailed overview, check out our video tutorial above.

See how the VWAP Edge Bands - NinjaTrader 8 Indicator looks in action with these screenshots

Learn how to use the VWAP Edge Bands - NinjaTrader 8 Indicator

The VWAP Edge Bands Indicator for NinjaTrader 8 revolutionises traditional VWAP analysis by incorporating adaptive, asymmetric deviation bands that dynamically adjust to real market volatility and directional bias. The core functionality centres around the golden VWAP line as the session's true volume-weighted mean, surrounded by intelligent deviation bands calculated using rolling median absolute deviation methodology.

As shown in Image 1 (pointed by yellow arrows), the lime green upper bands represent zones where price may be overextended to the upside—potential resistance levels where mean reversion or trend continuation opportunities emerge. The crimson lower bands (pointed by white arrows) indicate areas where price may be oversold—potential support levels where bullish reactions or further bearish momentum could develop. The navy blue fill between inner bands creates a clear visual balance zone around the VWAP, highlighting the fair value region where most volume-weighted trades occurred.

The indicator eliminates guesswork through automatic signal generation via painted price bars. In Image 2 (pointed by white arrows), purple bars appear when price breaks above the outer upper band with momentum aligned to VWAP slope, signalling a long continuation setup where traders should focus on bullish entries. Yellow bars appear when price breaks below the outer lower band with downward VWAP momentum, indicating a short continuation setup where bearish positions become favourable. When price re-enters the inner band zone after an extreme move, mean reversion counter signals appear, alerting traders to potential pullback opportunities. This colour-coded system keeps traders aligned with both momentum and mean reversion strategies simultaneously.

The VWAP line automatically anchors at the start of each trading session, refreshing all calculations to ensure accurate session-based context. This daily reset mechanism provides consistent intraday reference points for scalpers, day traders, and swing traders alike.

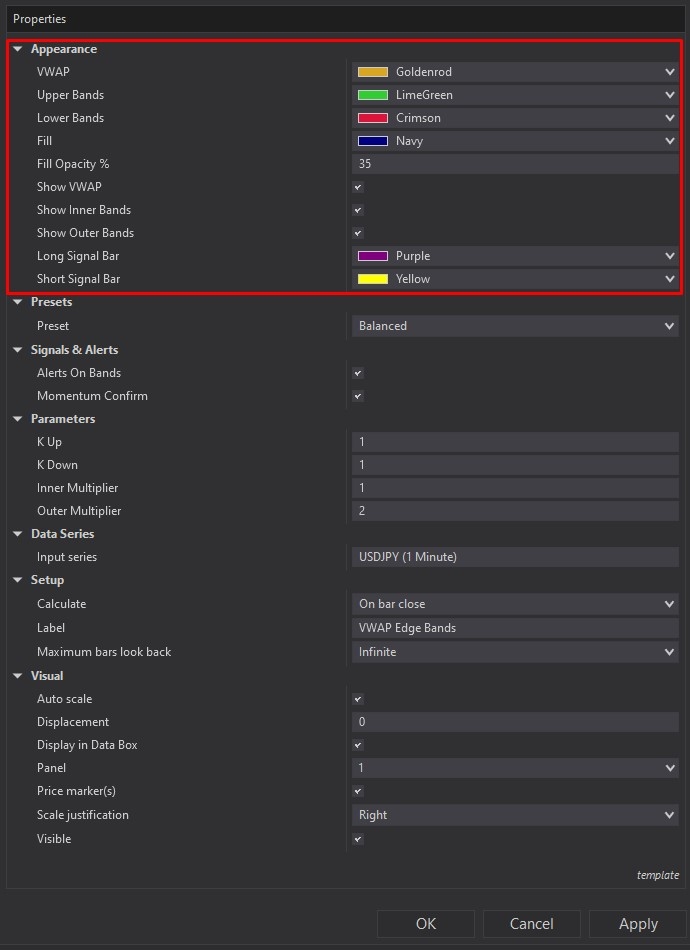

VWAP Edge Bands offers extensive customisation through its comprehensive settings panel. The Visuals section, highlighted by a red rectangle in Image 3, provides complete control over chart appearance, including VWAP line colour (default: goldenrod), upper band colour (default: lime green), lower band colour (default: crimson), fill colour for the balance zone (default: navy), and fill opacity percentage (default 35%). Individual toggle switches allow traders to show or hide the VWAP line, inner bands, and outer bands independently, enabling minimal chart setups for scalpers or full band displays for swing traders. The signal bar colours are also customisable, with long signal bars defaulting to purple and short signal bars to yellow for instant visual recognition.

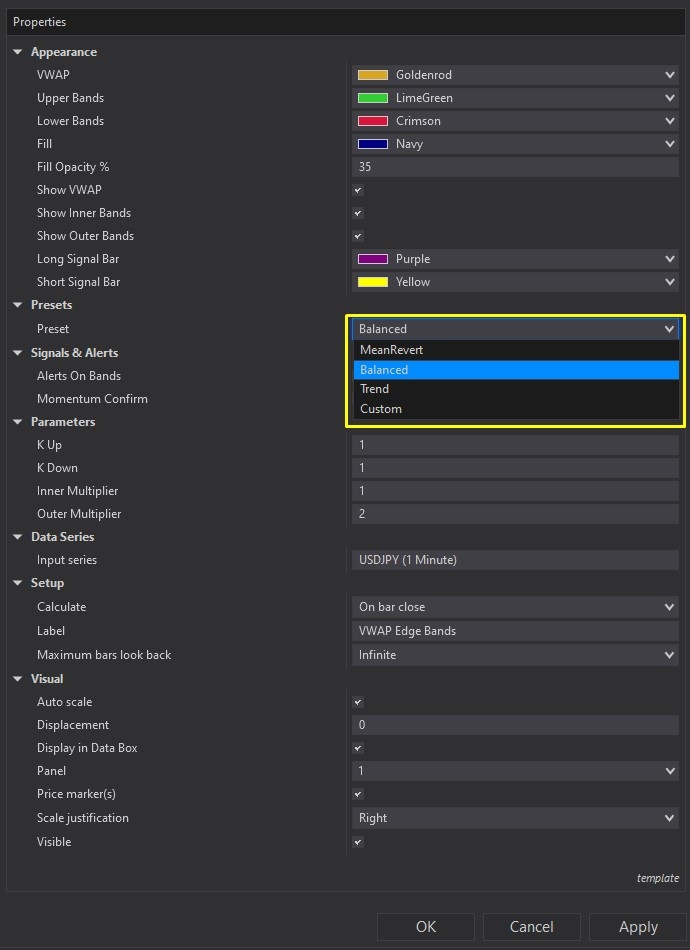

Image 4 displays the Preset Modes and Signals configuration options, highlighted by a yellow rectangle. The Preset dropdown offers four built-in profiles tailored to different market conditions: Mean Revert for sideways or choppy markets expecting price return toward VWAP, Balanced (default) providing optimal mix between trend and reversion scenarios, Trend for strong directional markets requiring wider bands, and Custom for traders who prefer manual tuning of every multiplier. The Signals and Alerts subsection enables powerful notification systems—when Alerts on Bands is activated, the indicator triggers visual alerts or sounds whenever price touches or crosses band zones, keeping traders aware across multiple charts. The Momentum Confirm option adds intelligent filtering by ensuring alerts only trigger when VWAP slope agrees with the move direction, helping traders stay aligned with the dominant trend and filtering false signals in choppy conditions.

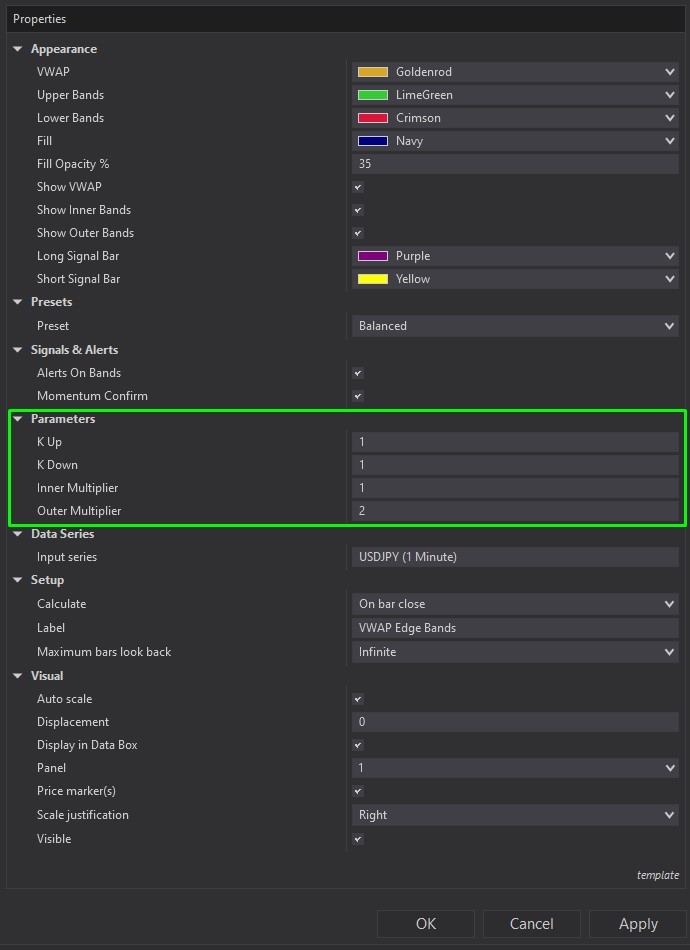

The Parameters section, illustrated in Image 5 (highlighted by a green rectangle), controls the sophisticated mathematical core of the indicator. The K Up and K Down multipliers determine how aggressively bands expand on the upside versus downside (asymmetric logic), allowing traders to adapt to markets with directional volatility bias—increasing these values makes bands more tolerant of extreme moves during high volatility, whilst keeping them near 1.0 maintains tighter bands ideal for mean reversion strategies. The Inner Multiplier defines the proximity of inner bands to VWAP, establishing reentry zones after extreme moves and prime areas for counter-trend setups. The Outer Multiplier controls the distance of outer bands from VWAP—when price breaks these critical levels, strong continuation momentum is indicated. Together, these parameters provide granular control whether you're scalping 1-minute charts or swing trading daily timeframes.

With full NinjaScript source code included, advanced users can study the complete rolling median absolute deviation calculations, modify the skew-aware band logic, adjust the session anchor behaviour, integrate signals into automated strategies, or build custom alert systems without any restrictions whatsoever. The source code package includes comprehensive documentation with detailed overview of calculation methodology, signal generation logic, preset configurations, and visual customisation options to facilitate deep understanding and flexible modification.

If you have questions about optimal parameter settings for different trading styles, stop loss placement strategies using VWAP levels, or trade management techniques for continuation versus mean reversion setups, refer to the comprehensive video tutorial above for detailed guidance on maximising the VWAP Edge Bands' effectiveness in your trading approach.

Secure payment via PayPal

By downloading, you agree with our Terms & Conditions