Click to play video

STRATEGY

Please Register for FREE account or Login to subscribe to this strategy.

By subscribing, you agree with our Terms & Conditions

This is a fully automated trading strategy developed for NinjaTrader 8.0.x.x and 8.1.x.x versions. This is one of the top NinjaTrader automated trading strategies on our platform that works with any instrument and any financial market as long as you have the Heikin-Ashi (HA) bar type on your chart since it is developed based on the HA bar type chart. You can use it on any time frame chart, but the daily time frame chart is the most effective historically. It mainly enters the market based on the change of colour of the bars and exits based on Advanced Exit options selected in strategy settings; HA bar charts are really interesting to trade on in terms of their bar colour change. Advanced Exit management options based on ATM Strategy and Stop Loss/Take Profile (SL/TP) are added in the latest upgrade. When you watch the video tutorial, you should be able to learn more about how to effectively use this strategy with all three different setups. One of the other amazing features of this automated futures trading strategy is if you close the chart or platform for any reason, when you restart the platform and re-open the chart with this strategy, keeping the same settings on, it will resume as if there were no gap between these two events. You just need to find the right settings and combinations for your trading style. Watch the video tutorial for further clarification and strategy details.

See how the HA Scalping Strategy - Premium Strategy looks in action with these screenshots

Learn how to use the HA Scalping Strategy - Premium Strategy to improve your trading

The HA (Heikin-Ashi) Scalping Strategy is a fully automated custom programmed strategy, developed by Rize Capital, to use with the NinjaTrader 8 trading platform. This strategy can only be used on Heiken-Ashi bar type; otherwise, you will see a reminder text on your chart like Image 2. This strategy is based on the change of colour of the chart bars and for exits, it has 3 setups.

For the first setup, the strategy enters a Long position when the bar transitions from red to green and a Short position when it transitions from green to red. Positions will exit automatically when the bar colour reverses to the opposite direction (as shown in Image 1).

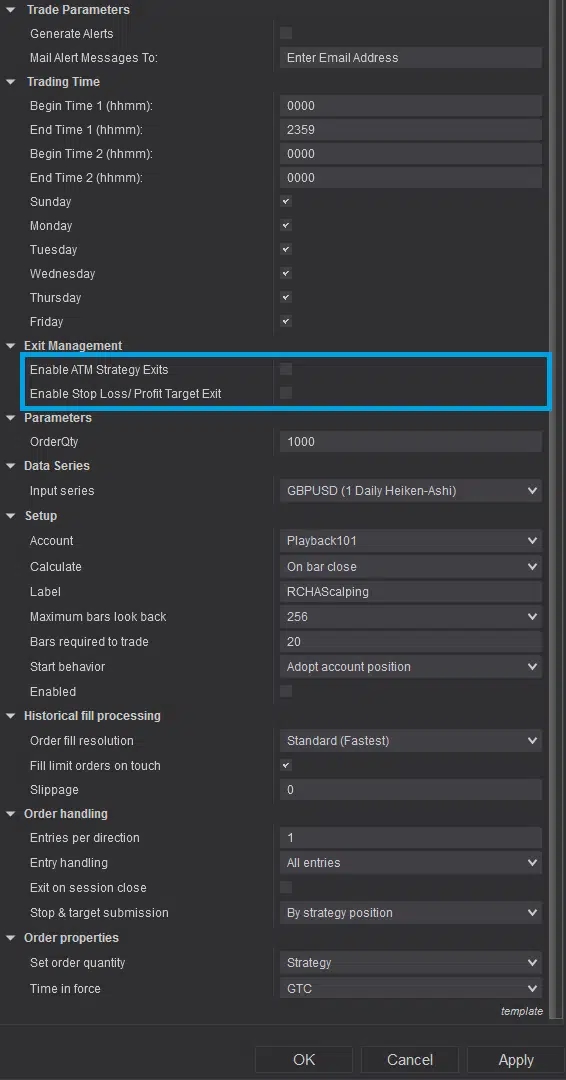

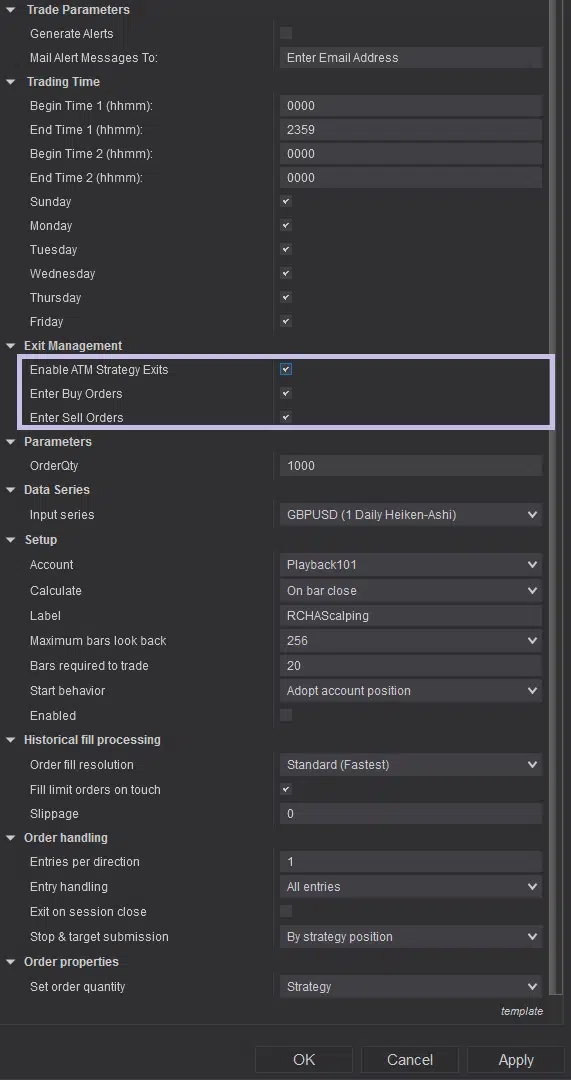

The second setup uses the same entry logic as the first but incorporates ATM strategy exits, which will look like Image 3. To activate this feature, you must check the ‘Enable ATM Strategy Exits’ from the setting parameter (highlighted in blue in Image 10). In this mode, the strategy exits positions either when ATM strategy orders (e.g., profit target or stop-loss) are triggered or when the bar colour reverses, whichever occurs first. Users can filter trade directions by selecting Long only, Short only, or Both in the parameters (highlighted in purple in Image 11). If both options are unchecked, no orders will be placed. Important: An ATM strategy must be selected in the Chart Trader panel for this setup to function; failure to do so will result in no orders being submitted (this requirement was emphasised to prevent user oversight).

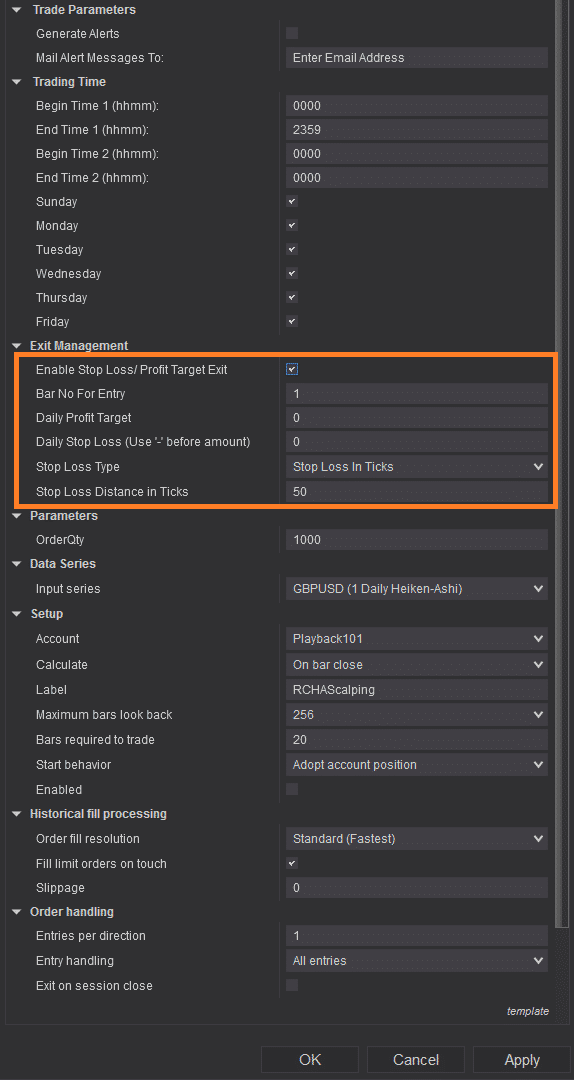

For the third setup, you can configure trade entry delays, Daily Maximum Stop Loss/Take Profit, and Fixed Stop Loss/Trailing Stop Loss (as shown in Image 4). To activate this, enable the ‘Enable Stop Loss/Profit Target Exit’ option in the settings (highlighted in blue in Image 10). Once enabled, additional customisation parameters become available (highlighted in orange in Image 12).

The ‘Bar No For Entry’ parameter defines the number of bars the strategy waits after a colour change before entering a trade. The ‘Daily Profit Target’ field allows users to set a daily profit threshold; once reached, the strategy halts new entries for the day and displays a notification (Image 5). Trading resumes automatically the next day. Similarly, ‘Daily Stop Loss’ sets a maximum daily loss limit and triggers a notification (Image 6). Please make sure you add the ‘-‘ sign before the amount value in this parameter.

You can select between a Fixed Stop Loss or Trailing Stop Loss via the ‘Stop Loss Type’ parameter. The stop-loss distance is calculated using the value entered in ‘Stop Loss Distance in Ticks’. If the bar colour reverses before the stop loss is triggered, the strategy will exit the position immediately and re-enter only when a new valid setup forms.

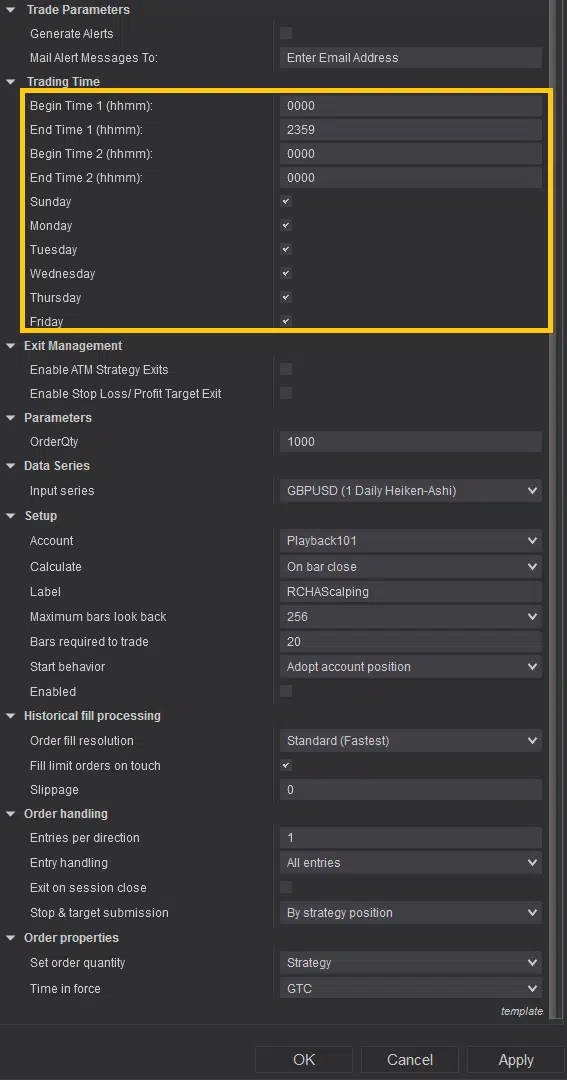

There may be periods during trading hours when chart bars’ colours change excessively frequently (e.g., the area marked by the red rectangle in Image 1), which could be unfavourable for trade entries using this strategy. As the strategy is fully automated, you can pre-define the strategy’s active trading periods by selecting specific time ranges and days in the settings (highlighted by a yellow rectangle in Image 8). This allows you to exclude historically unfavourable periods based on bar colour volatility, ensuring no trades are placed during these pre-set intervals.

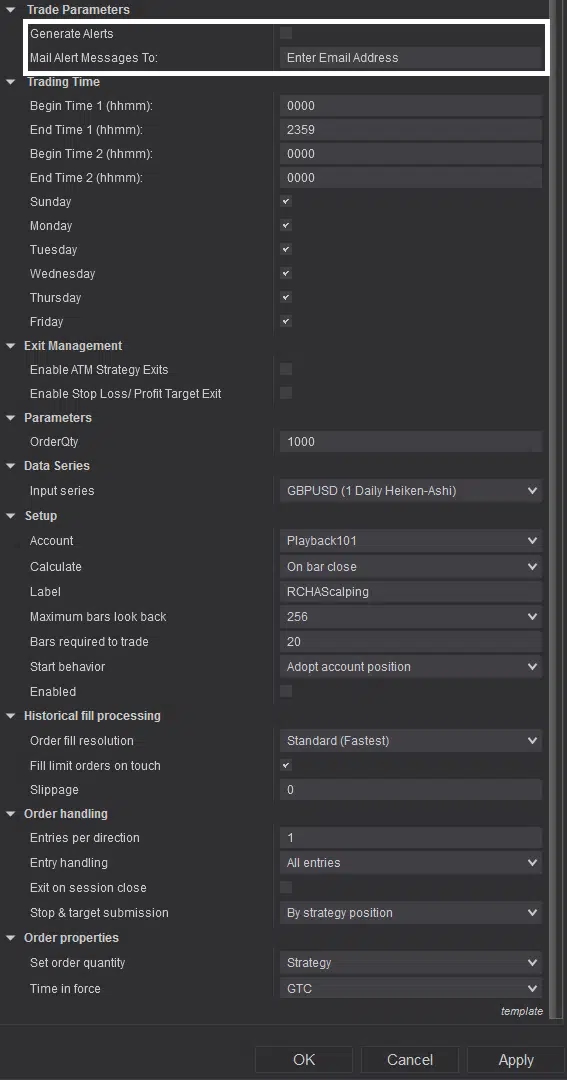

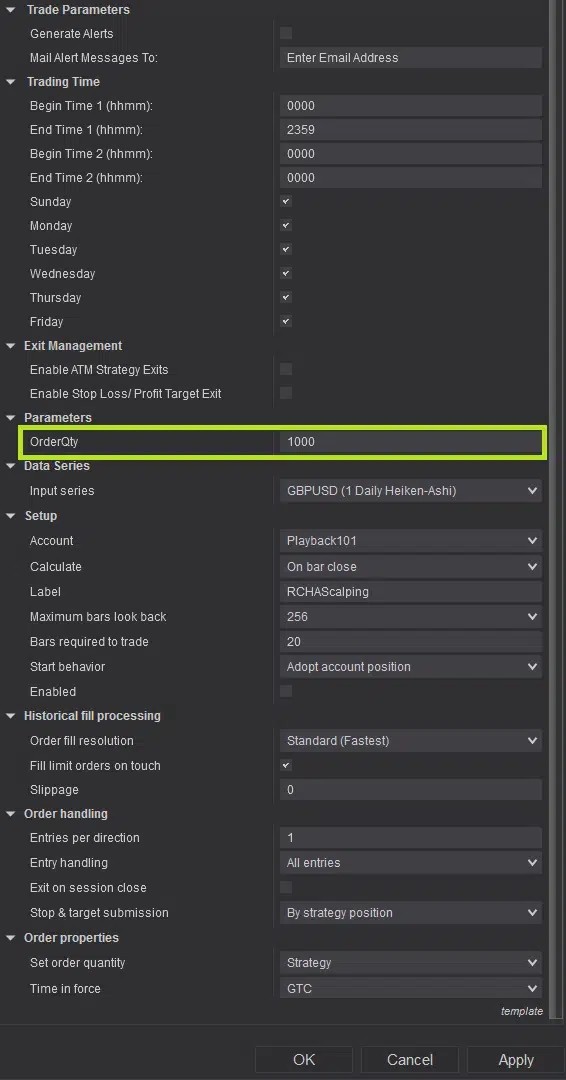

Now, it’s impossible to always keep an eye on the trading platform to know when a position is entered. That’s why you can configure email alerts via the parameters highlighted by the white rectangle in Image 7. By entering your email address and enabling the ‘Generate Alerts’ checkbox, the strategy will notify you via email when a position enters or exits. Additionally, the trade quantity (position size) can be customised using the field highlighted in lime green in Image 9.

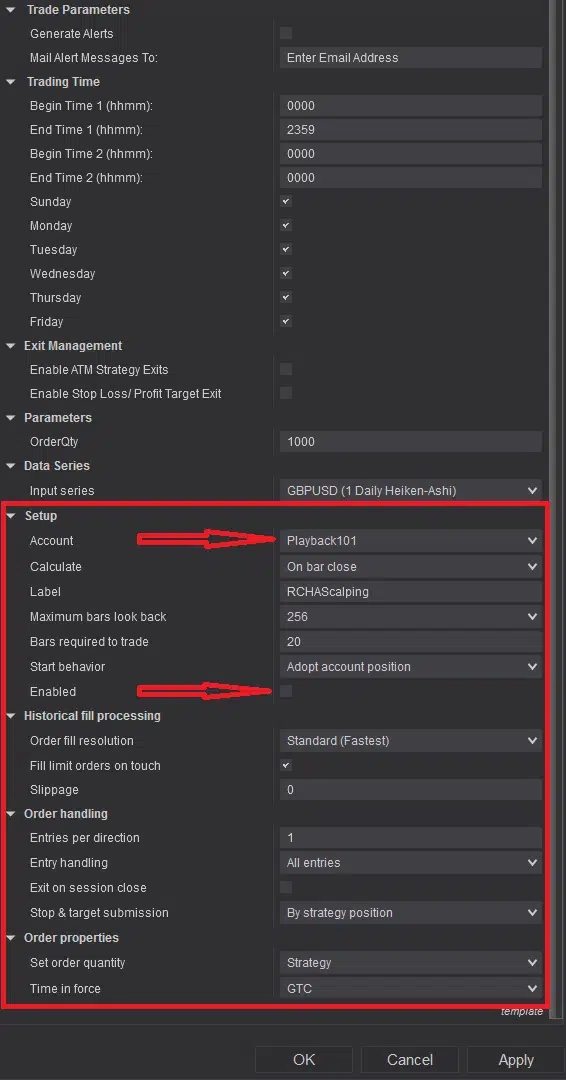

It is strongly advised to avoid modifying default settings within the red rectangle in Image 13 (except selecting your trading account and enabling the strategy, as indicated by the red arrow) to ensure proper functionality.

See how the HA Scalping Strategy - Premium Strategy has evolved over time