The Forex market is the most active financial market in the world. Every day, traders from all over the world engage in foreign exchange transactions. The world tensions can also have direct implication on the foreign exchange rate. Today, due to the global and inter-connectedness of the Forex market, even the minor events can affect the values of currencies, let alone the major ones.

There are different types of events that may influence the foreign exchange values. These include political events, natural disasters, and wars. Let’s discuss them briefly.

Effects of Political Tensions on Foreign Exchange

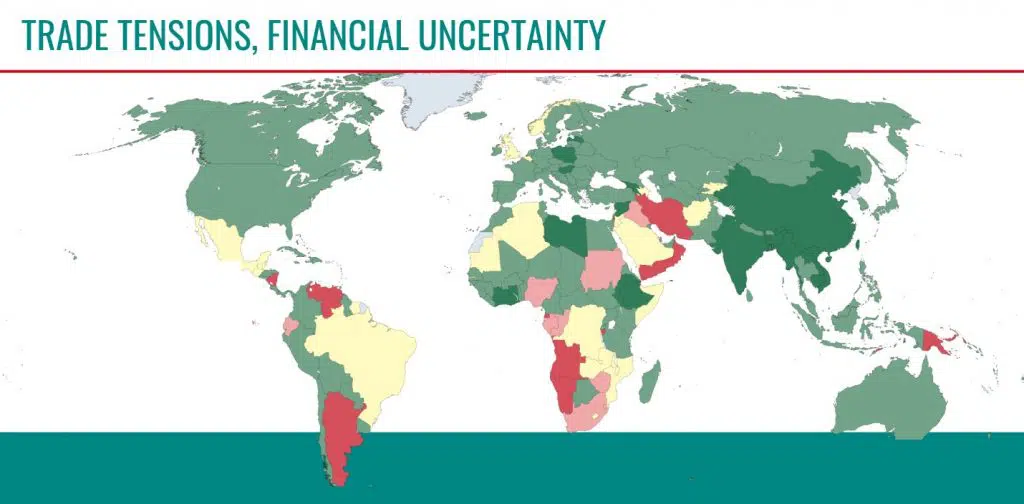

One of the most common types of world tensions is the political one. There are very common instances when the political leadership of two currencies cannot create consensus on different matters. Hence, the political differences remain between the two and the effect is reflected on the values of their currencies. The US China Trade War is a recent example that pulled the foreign exchange markets in between. The countries, although are far from embracing their currencies as a weapon, many countries have been forced to support the US Dollar.

The Central banks also seem quite intent on keeping their respective currencies steady and taking measures to stop the money from escaping the economy and probable devaluation. The standoff between the two economic giants pushed the investors on the backfoot and they seemed quite indifferent to investing in the market until the situation improved. The political event can also arise domestically and may affect the value of the currencies in the Forex market.

Effect of Natural Disasters on Foreign Exchange

Natural disasters can be devastating for a country. Although it is not a world event but the value of the currency may get affected because of the instability within the country and need of resources. The damage to major factories and distribution centers, loss of precious human lives along with the uncertainty that comes with natural disasters, are all bad news for a currency. In natural disasters, infrastructure is damaged badly and infrastructure is the backbone of any economy. When the economy suffers, the effect reflects on the currency directly. Moreover, the government has to bear the additional costs to clean up and rebuild after a disaster.

Effect of War on Foreign Exchange

When two or more countries engage in a war, the impact is more devastating than a natural disaster. The impact of war is widespread and brutal. This is a huge blow on the infrastructure and the economy nearly comes down to its knees with no chances of betterment in the short-term. It can take years to make the country return at the same point that it was prior to the battle. In order to rebuild, the countries charge lower interest rates that decreases the value of the currency. This also reflects on the health of the nation on the long-term.

The world tensions between countries or a global recession has a direct relation with the values of the currencies.