RCPM - Portfolio Manager

Use FREE Version Now

WATCH THE VIDEO TO KNOW MORE ABOUT

RCPM - Rize Capital Portfolio Manager

FREE Licence

-

PAY Nothing for this FREE Version

-

Suitable for exploring RCPM

-

No obligation to upgrade

-

Tech Support through Email

-

Limited access to add Asset class / Sector / Instrument

Full Licence (Monthly)

-

Full access to all the features and reports

-

Add Unlimited Asset class, Sector, Instrument

-

Allocate acceptable deviation to Assets, Sectors and Instrument Level

-

Generate reports of Watch List, Current Allocation, Current portfolio with advanced filtering option

-

Downgrade to FREE Licence any time

-

Tech support through Remote assistance & Email

Full Licence (Yearly)

-

Full access to all the features and reports

-

Add Unlimited Asset class, Sector, Instrument

-

Allocate acceptable deviation to Assets, Sectors and Instrument Level

-

Generate reports of Watch List, Current Allocation, Current portfolio with advanced filtering option

-

Downgrade to FREE Licence any time

-

Tech support through Remote assistance & Email

If you are already subscribed to Full Licence Plans and want to unsubscribe, Please click here

'RCPM - Rize Capital Portfolio Manager' Details:

This indicator plots lots of volume related information and insights at price level for each tick. It does plot on historical data and market replay for you to backtest. Also this indicator can be used for any financial instruments. Now, it has 3 main parts which are left side volume profile, daily session POCs and right side Volume profile. Now all these works independently ie, settings of one does not affect the other. With the right margin volume profile you can plot for any number of days buy and sell volume at tick level to any user defined tick levels. Traditional volume profiles does not plot on buy sell volumes separately on top of each other; thus you have no clue which side is stronger than other. But this indicator plots buy and sell volume separately and on top of each other so that you know at that price level which side is stronger.

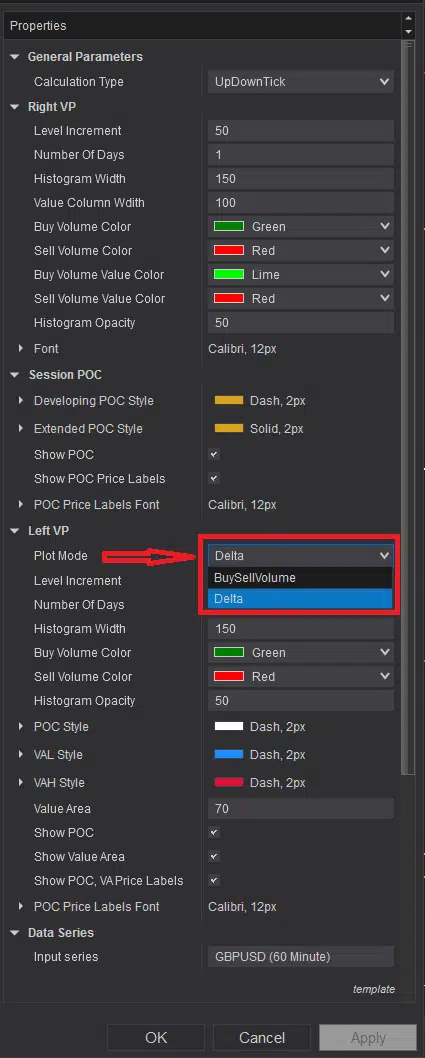

It does plot daily sessions extended POCs so that you know what were the prices this instrument had accepted fair prices in the past and most of the cases, a good area considered to be rebound. On the left side which is shown with Red arrows in both Image – 1 & 2, is left margin volume profile. The main difference from right margin volume profile is, it has options to select to plot Delta or Buy Sell Volume. And you can also select number of days volume profile and number of tick size for the each bar for this volume profile and all these are independent from right margin volume profile.

If you want to keep an eye for longer term volume profile on left margin whilst plotting the historical and live daily sessions’ extended POCs on the chart and a volume profile to execute on the market on the right margin, this is the perfect indicator for you.

Now right margin volume profile shows both buy and sell volume separately on top of each other. If you look at closely at Image – 3 where Red down arrow shows how it is plotted. Unlike traditional volume profile, this plots shows you who is actually controlling the market at that level, whether you have got more buyer or seller at the price level or not and that is a huge edge for anyone. Now if you see Image -4 where Red down arrow is plotted, you will be able to see the buy and sell value real time alongside of volume profile at price levels. That will give you more information if you need the actual data value of the bars. Right column shows Buy or Uptick volumes and left column shows Sell or Downtick volumes depending on the type of instrument you are using.

In Image -5, you can see that Left margin volume profile plots Value area high, Value area low and POC for that. It is very useful to keep an eye on long term market value area and POC. Now In Image – 6, you can see daily sessions’ extended POCs are plotted, but most important part usage of it is, when price touches these, it stops plotting. The reason behind it, if previous POC is traded now, it is unlikely price is going to stop there; rather it may go up or down to the next extended POC lines. There use of historical extended POCs are so useful to see potential price rebound from those levels. All these POCs or VAH, VALs also plots price labels, so that you don’t have spend time to figure them out which is shown with arrows in Image -7.

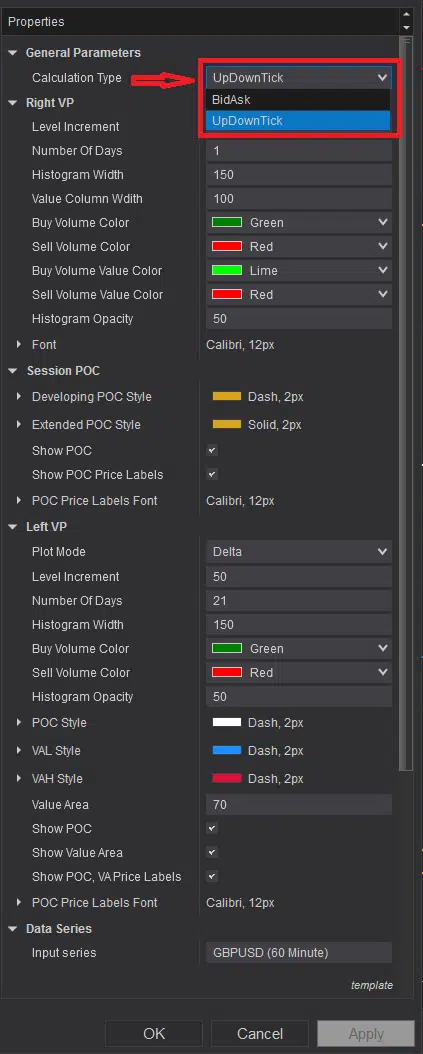

Now if you look at indicator settings, you will see at the top ‘Calculation Type’ and you will have options to select BidAsk and UpDownTick (Image – 8, marked with Red arrow and Red rectangle). This will depend on the instrument you are trading. Use BidAsk, if your instrument has real volumes; but if you are trading instruments like forex which does not have real volume fed through, you need to use UpDownTick.

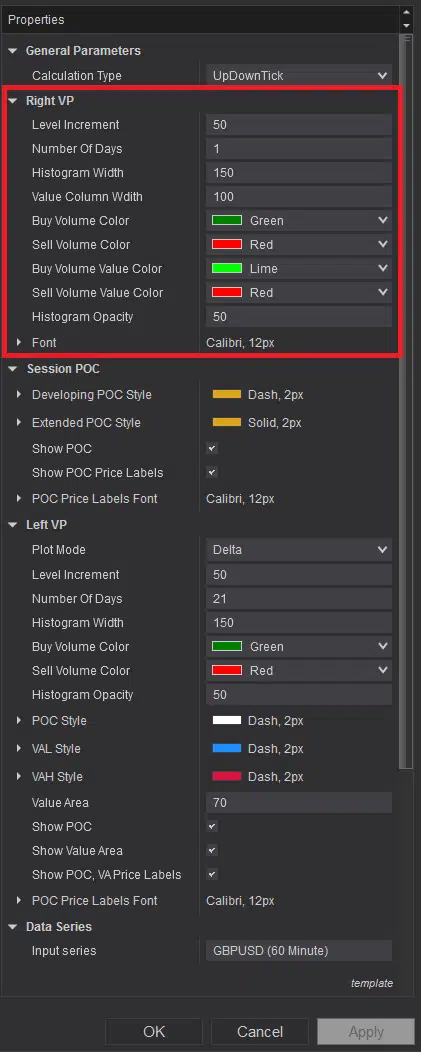

Now to customize the settings and plots for Right Margin Volume profile, you can do that from the section highlighted by red rectangle in Image -9. Level increment is for the height of the volume profile bars. If you want your bars to plot for each tick level, then input 1; otherwise if you want your VP bars height any other tick size, you can input that. You need to input number of days’ VP you want to plot on your right margin VP in where is says ‘Number of Days’. But its important to remember, all these are for only right margin VP, it does not affect any other plots of this indicator. Histogram width by default is kept 150 which is the margin after the current live bar so that chart bars does not overlap the VP, but if you want, you can change them as per your requirement. Value column width is the space left at the right margin to plot buy and sell volume values which were shown in Image -4. If you want to change the width, you can customize them. Now rest of the settings in that section is for customizing the colors, font. You can change them as per your requirements.

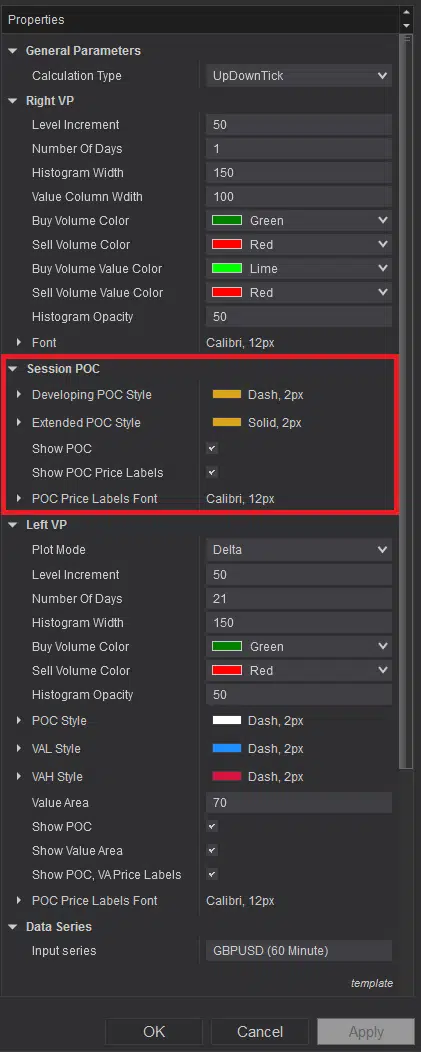

Image 10 shows the section for customizing daily sessions’ plots. You can change the color of the POCs and fonts in this section depending on your choice. And also if you don’t like to plot the POCs or the price labels on them, you can switch them off by unchecking those options. By default it plots them.

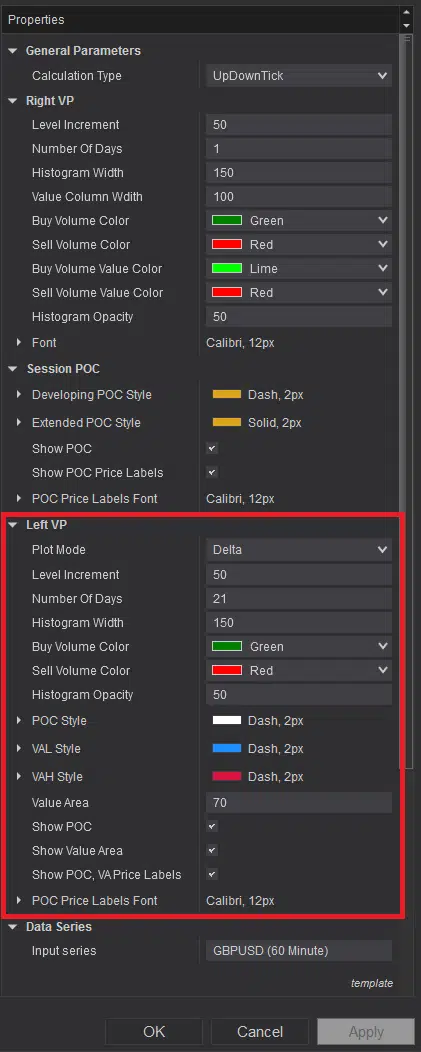

In Image – 11, you can see the option to select between BuySellVolume and Delta for left margin Volume profile. This was explained above with ref to Image -1 and 2. You can select the settings of your choice for left margin Volume Profile from the section highlighted with red rectangle in Image – 12. You can choose the Level increment from each tick to any number of tick size you prefer for your left margin volume profile each bar height. You can also select Number of Days from 1 to any to plot. It also has Histogram width it to plot so that it does not cover the whole chart, you can change if you want the change the area it should cover on left margin of the chart. Then you can customize the colors of the POC, Value area high and Value area Low lines. Now in the option where it says ‘Value Are’, that is actually is the number of percentage used to calculate the value area for your left margin volume profile. If you don’t want to plot any specific line or lines from left margin POC, VAH or VAL, you can uncheck those option for not plotting based on your requirements.

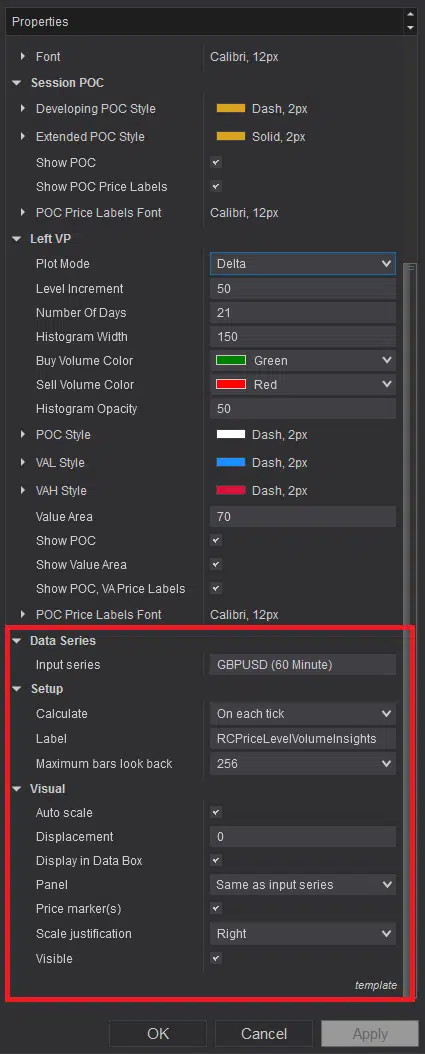

Now the section highlighted with red rectangle in Image – 13, its recommended not to make any changes there as it may cause this indicator to function correctly. Its suggested to keep those settings as default without any change.

Upgrade Notes:

Version: 5.2.0.1

- This can be used on any instrument

- Switch between UpDownTick and AskBid volume types

- Left and Right margin Volume profile plots separately and independently

- Option available not to plot daily sessions' POCs

- All colors and fonts are customizable

- Auto update and announcement added

Beginner Level

Learn NinjaScript programming without any prior programming Knowledge-

Perfect for someone without Prior programming experience.

-

No subscription. One Time Price.

-

Learn how to code custom indicator and strategy in 4 Months.

-

Weekly 1 hour weekend Session.

-

End of every session - Home Works given.

-

Offline access to recorded sessions.

Advanced Level

Learn to program Automated Strategy & Indicators for NinjaTrader 8-

Beginner Level Recorded sessions comes for Free with this so that you can start from beginning.

-

Practical programming focused sessions and keep all source codes.

-

One Time Payment - so No Extra Cost.

-

At the end of this Level, you should be able to custom program without help.

-

End of every session - Home Works given.

-

Offline access to recorded sessions.

-

Only Advanced Level ninjascript programming course duration 4 months.

-

Weekly 1 hour Weekend Session.

Get OFFERS & DISCOUNT Every Month

by registering and subscribing to our Subscription List Here

Subscribe here for our Offers / Discounts/ Bonus/ Promotions

Not ready to subscribe yet?

join us for free to explore more

With free account, you can visit different parts of this website. You can get free indicators, strategies, videos and free bonuses. There is nothing to lose with free account.