You may have read about the balance of payments and trade deficits in newspapers. However, the reports that you read do not explain how they affect the currencies in the Forex market. This is because the countries don’t want to make all the confidential information public for a number of reasons. In order to understand how the trade and current accounts impact Forex market, it is vital to know the function.

The current account deficit, as we all know, occurs when a certain country spends more money on the imports as compared to the earnings through exports. That means more outflow of money and less inflow of money. The current account is the receivables and payments of goods and services, investments, and other money sent outside the country. This type of deficit usually occurs in developing or underdeveloped countries.

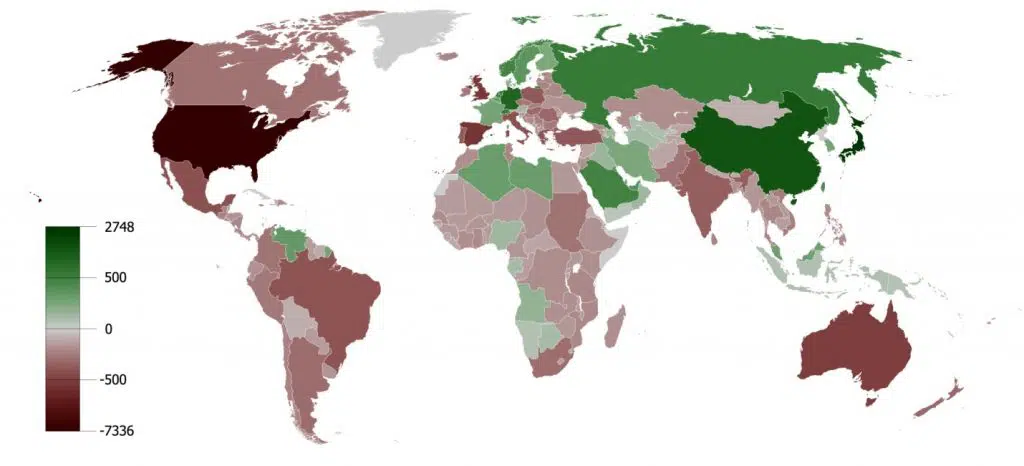

On the other hand, we have a trade deficit, which is the largest component of a current account deficit. This deficit explains the country’s balance of trade between the goods and services it imports and exports. What this term explains is that there are more purchases than sales. So, the country owes more than it has to receive from others. In the opposite scenario, when there are more sales than purchases, the current account is in surplus.

Trade and Current Accounts Impact Forex Market

By this time, we now know how the trade and current deficits are occurred. But do they have any implication on the Forex market or the value of the currency? Yes, it has. There is a general misconception that the money gets recycled in the Forex market and it is returned to the country but at a lower exchange rate. This is not the case at all.

Transactions in the Forex market change the ownership from one foreign owner to the other. The amount a country has spent on the purchase of goods or services or foreign investments can only come back through foreign trade or investment gains. A trade deficit is generally not bad for an economy. The thing that matters is how the foreign investors are assessing this economy. If the deficit is increasing because of the recent purchases of raw materials or the development of infrastructure, it can be a positive deficit because the developments will ultimately improve the economy. In this case, the Forex investors will be looking to buy the country’s currency and the value will improve.

In case, the trade deficit is arising out of payments of loans, interests, or purchase of luxury for government officials that mostly happen in underdeveloped countries, it is a negative risk and the investors will back out. Ultimately, the value of the currency will decline and the Forex traders will opt not to invest in the currency. This happens because the country is not investing wisely for the economic growth. Too much consumer debt and low saving rates are two negative factors that should be avoided because they lead to imbalances in the economy and do not fuel future expansion.