Moving averages help traders to identify market trends and analyze markets. The two most widely used moving averages are simple moving average (SMA) and exponential moving average (EMA). Besides there are other tools using counter trading principles and algorithm to determine strong market trends whilst filtering out ranging market, like Rize Capital’s EMA Bounce Strategy.

EMA Bounce Strategy

The fundamental principle of this strategy is Pro-level counter trading in strong trending market.

The EMA Bounce Strategy is a fully automated strategy where entry orders are placed when the trend is strong and suspended when there is no strong trend, i.e. when the market is choppy. Profit targets are placed via two varying settings that can be pre-set. The first of these settings helps an investor to exit with a fixed profit target strategy while the second enables the investor to trail the market price for 1/3 of the market position after taking profit for 2/3 of the position until Stop Loss is hit.

Features/Benefits of the EMA Bounce Strategy

- 30 days FREE TRIAL.

- LifeTime update and technical support.

- With underlying counter trading principle, traders get the best possible entries with higher risk-reward ratio avoiding entering too late.

- The EMA Bounce Strategy can be run on any intraday timeframe.

- This strategy enters and exits positions with a quantity of multiple of 3 and therefore, quantity for this strategy has to be at least 3 or multiple of 3.

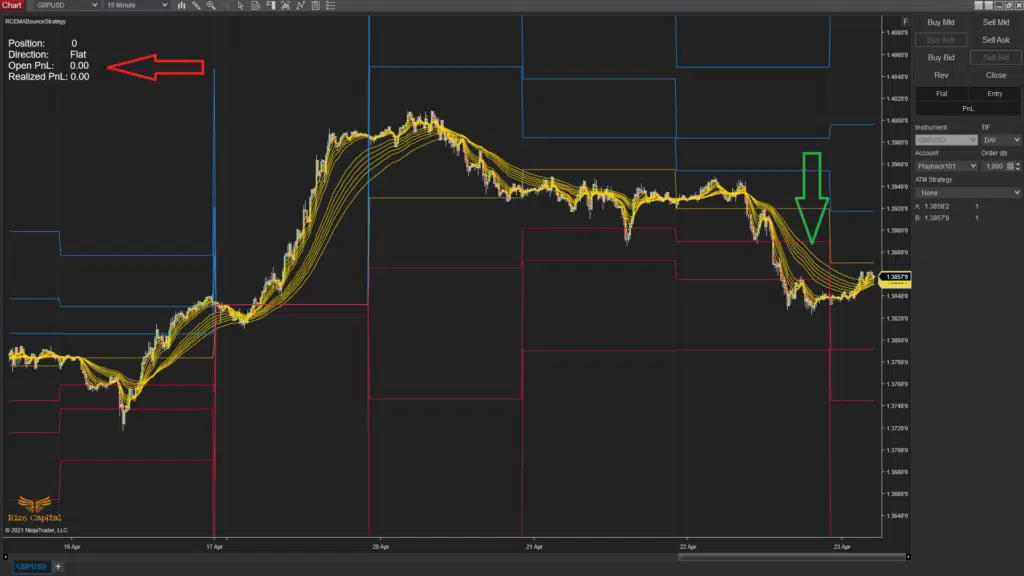

- The information panel located at the top-left section of the chart, as indicated by the red arrow, will show you very useful data for you to observe.

- If the market price hits a pending order, then it will enter the market but if there is an opportunity to get a better price in the next candle then this pending order will be moved up to help get a better market price for the trader.

- Upon entrance into the market, this strategy will help place stop loss and profit targets albeit according to historical pivots.

- It will also automatically update the stop loss quantity any time where there is a change to the current position.

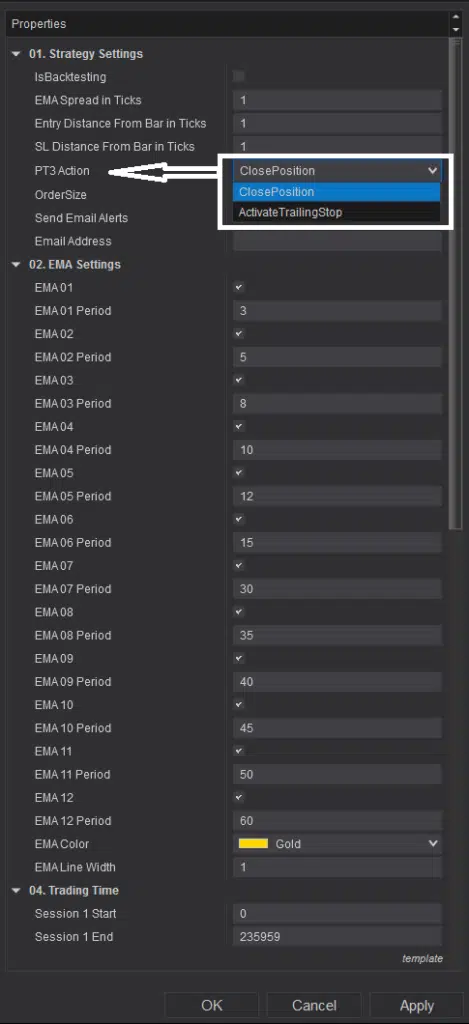

- Selecting profit target settings either ‘PT3Action’ or ‘ClosePosition,’ as shown by the area highlighted in white and an arrow in the following image will make EMA Bounce Strategy to place 3 profit targets for fixed or last PT as trailing PT to gain the maximum.

- In case you wish to back-test the EMA Bounce strategy with the strategy analyzer, then simply check the box next to the parameter ‘IsBacktesting’. Failure to follow this procedure can lead to an inaccurate back-testing result. However, for traders using this strategy on live data for live or sim trading, there’s no need to check the box.

- You can alter the quantity to enter via the ‘OrderSize’ parameter. However, any alteration has to be within a minimum of 3 or multiple of 3.

- This strategy is designed to enable you get email alerts for order executions. All you need to do is to check the box next to ‘Send Email Alerts’ and then enter your email address in the box next to ‘Email Address’.

- It is possible to manage the number of EMAs you wish to use to determine whether the present market is on-trend or otherwise. This you can achieve by checking the numbered boxes of all EMAs of interest. It is also possible to customize the periods according to your preferences as well as alter the color of the EMAs or the width of the plot lines via this segment of the settings

- From the settings , it is possible to choose time ranges and specific days when your orders should be placed.

- You can cancel your subscription anytime.

Conclusion

This is a strategy that can detect the definite market trend (downtrend and uptrend) but places an entry order only when there is a strong market trend. In other words, EMA Bounce Strategy entry orders are placed when the trend is strong and suspended when the market is choppy because of the tendency to lose profit under such conditions. It is beneficial to trader because it will always ensure they enter the market using counter trading principle when odds are in their favour. So, to maximize your trading profits, simply visit EMA Bounce Strategy and subscribe to this amazing strategy today! You’ll also catch a glimpse of all the other quality Rize Capital strategies/products upon your visit at rizecap.com.